Packaging & Print

For you, no shape is too complicated, no material is too difficult for us. Thanks to our state-of-the art printing and finishing methods, we can offer you a great range of haptic and visual effects.

E-Commerce

With our range of services, we offer you a complete webshop solution, very efficient and cost-effective, covering all key e-commerce functions.

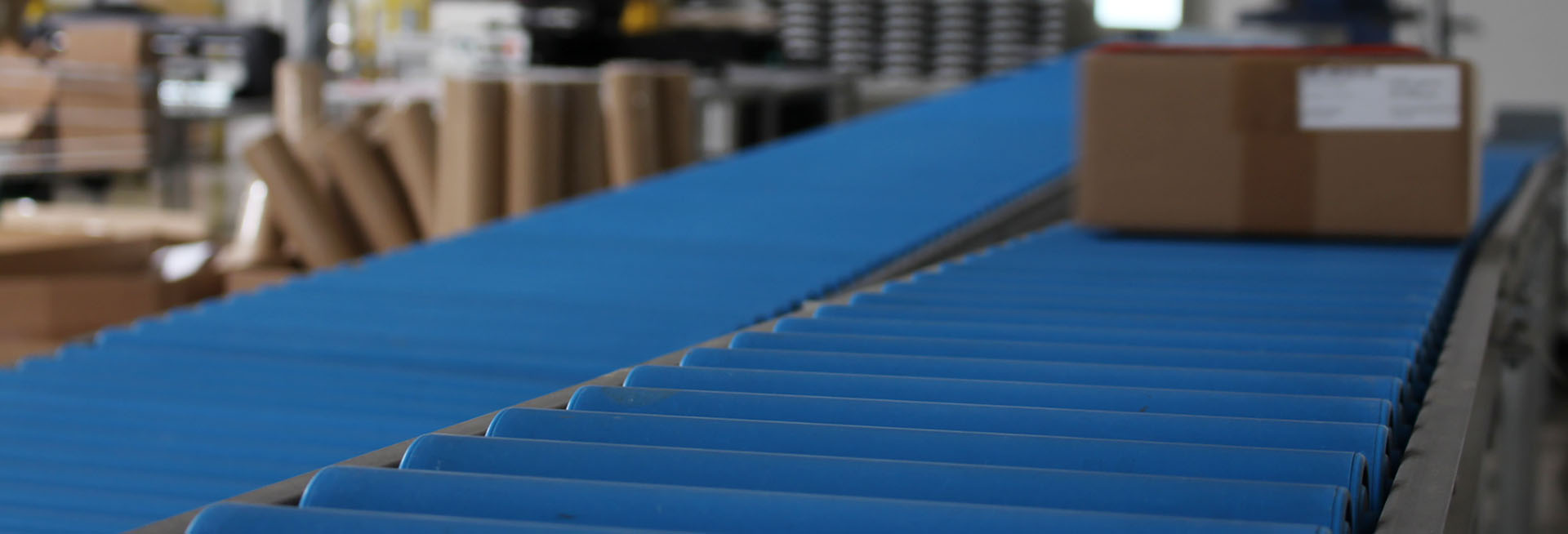

Logistics & Fulfillment

Ordered today — delivered quickly. RHIEM meets this claimand and has the necessary experience and competence for smooth and reliable logistics — worldwide.

Promotional Material

RHIEM analyses your product range and provides you with promotional material that suits your needs. We develop online platforms for the centralized management of your marketing material, provide the logistics services.

Current Press-releases

Shipping hub for TEEbooks

Fast international delivery

Brand manufacturer TEEbooks has delegated its fulfilment to RHIEM, has its design furniture shipped from Voerde to all over the world and no longer even has to worry about customs and export issues.

Flexible Service for Recommendations

RHIEM cooperates with DOUGLAS

Assemble and ship hundreds of parcels within one day: RHIEM supports the DOUGLAS Beauty Tester program with flexible and professional fulfillment.

Legwear packed and shipped in a sustainable way

Shipping Support for British Companies

The British startup Hedoine pushes for the highest standards in sustainability with its elegant products – and with that lets RHIEM support its growth expansion by shipping in Europe.